We are trusted barrister accountants and we act for several hundred members of the Bar across England & Wales.

Barrister incorporation is something we are often asked about here at Jack Ross Chartered accountants. A lot of our barristers have benefitted from our advice regarding if this is a route that they should take.

Below is an update on the Bar standards board which provides a starting point for your research on this. Once reading the below you may find there are still questions that remain unanswered. This is where we come in!

Our barrister accountants have years of expertise on this subject and will be happy to arrange a meeting to discuss this further with you.

UPDATE ON BAR STANDARDS BOARD

It is some six years since the Bar Standards Board began accepting applications from Barristers who wish to practice through a separate legal entity, thus paving the way for barristers to operate through a limited company.

Since then some 75 entities are now BSB Authorised Bodies meaning that they are fully owned and managed by authorised individuals being barristers with a current practising certificate. Most of these are sole practitioner barristers who own 100% of the share capital of their Company.

Only 6 Licenced Bodies {Alternative Business Structures} are currently on the register which are owned and managed by jointly authorised individuals or others.

THE TAXATION COMPARISON

As a result of the budget presented on 3rd March 2021 we now know that tax allowances will be frozen for the next five years and that corporation tax rates, currently, 19% will increase for companies with profits of £250,000 to 25% from April 2023. The rate for small companies will remain at 19% for profits up to £50,000 and will taper between 19% and 25% for the band in between.

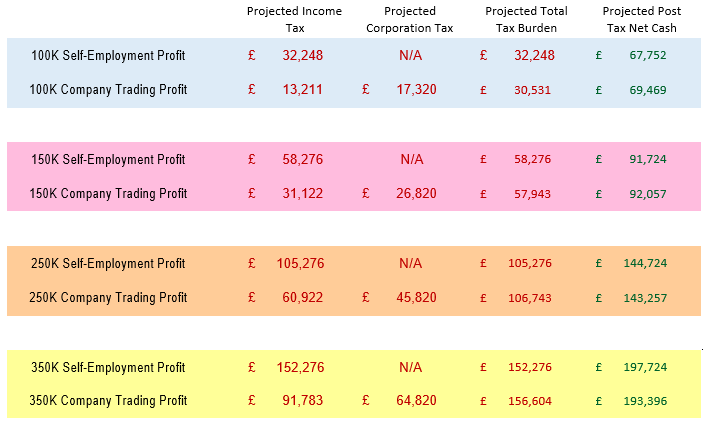

We have compared the tax burden in 2021/22 resulting from self-employment with that of incorporation at different profit levels based on the current rate of corporation tax at 19%. The table below shows the net retained post-tax cash for taxable income of £100,000, £150,000, £250,000 and £350,000

As you can see from this table incorporation where profits are less than £150,000 is marginally more tax efficient, but after allowing for the extra costs of administration and the burden of increased regulation the savings will be fully eroded.

As profits rise it becomes more tax efficient to remain a sole practitioner and with the prospect of increasing corporation tax rates in 2023 this gap will widen further.

THE PRACTICAL IMPLICATIONS OF INCORPORATION

A) The immediate issues to resolve

- Agreement to be reached with chambers to admit the limited company as a member.

- Carry out all obligations in respect of registration with the B.S.B.

- Ensure that the company meets all its obligations to register with HMRC for Corporation Tax, VAT and PAYE if appropriate.

- Put in place professional indemnity insurance.

- Ensure that a Service Contract is drawn up between the individual and the company to regulate the duties and remuneration of the individual in their capacity as director of the company.

B) Cessation of practice

- The status as a self employed barrister will cease and final accounts will need to be prepared to that date.

- This may accelerate tax liabilities if the individual currently has a year end other than 31 March.

- Outstanding work in progress will need to be billed up to that date.

- The existing VAT registration will need to be terminated and in most cases VAT on outstanding fees will need to be accounted for as and when received using the barrister deferment scheme.

- Income tax will be due and payable on post cessation receipts in the tax year of receipt {to the extent that they exceed the value of debtors included in the cessation accounts}.

- The leasing of any assets, such as a car, currently financed on a fixed term agreement must be considered since the agreement will be in the name of the individual who will no longer be operating a business.

TAXATION ON INCORPORATION

C) The new Entity

- The barrister will need to operate the company at arms length, meaning that the assets of the company are separate from the individual.

- This represents a major change in thinking since most barristers do not currently use a separate bank account for their business activities

The company will need:-

- To be incorporated and register with Companies House and meet its obligations to file an Annual return of its directors and shareholders and to file accounts in accordance with company law within nine months of its year end.

- To keep accounting records in accordance with company law.

- To operate a separate bank account in the name of the company and ensure that all fee income is paid into that account.

- To meet its obligations to file a Corporation Tax return within twelve months of its year end and to pay corporation tax on its taxable profits within nine months of the year end.

The Director will need to:-

- Ensure that all of the above matters are addressed.

- Ensure that only funds that are due to the director/shareholder by way of salary or dividend are paid out.

- Ensure that the company trades in a position of solvency and is able to pay its debts as they fall due.

A) The company will pay

- Corporation Tax at the rate of 19% on its taxable profits, rising to 25% on taxable profits above £250k from April 2023, payable nine months after the year end.

- PAYE being income tax, employees and employers National Insurance Contributions based on any salaries paid by the company need to be accounted for and a digital return must be filed with HMRC on a monthly basis.

- VAT on a receipts basis on fee income received less VAT on expenses incurred. VAT Returns and the payment of VAT will be due on a quarterly basis as per existing Making Tax Digital arrangements.

B) The individual will pay

- Income tax and national insurance on final profits from self employment.

- Income tax on post cessation fee receipts to the extent they exceed the value of the debtors included in the final accounts.

- Tax and national insurance as an employee on any salary paid by the company to the extent it exceeds the current {2021/22} personal allowance for income tax of £12,570 and for national insurance of £9,568.

- Higher rate income tax on any dividends paid by the company of 7.5% on dividend income up to £50,270, 32.5% on dividend income between £50,270 and £150,000 and 38.1% thereafter {2021/22 rates}.

THE ADVANTAGES OF INCORPORATION

- The ability to control the level of income that is drawn from the company and therefore the amount of income tax payable from year to year {subject to the payment of corporation tax at the appropriate rate on the company profits}.

- The ability to retain profits in the company which can accumulate until retirement when the company could be liquidated and funds extracted at Capital Gains Tax rates assuming they remain lower than income tax rates.

- The ability to make pension payments directly out of the company on behalf of the director, thus saving national insurance, subject to annual allowance restrictions.

- The ability to buy a zero emissions electric car and write the cost off against company profits in the year of purchase, subject to there being a taxable benefit in kind, albeit at only 1% of cost for 2021/22.

- The saving of national insurance Class 4 contributions of £3,663 (being 9% on income between £9,568 and £50,270) plus a saving of 2% on all income above £50,570. (2021/22 rates)

- The ability to pay a partner/spouse a salary from the company.

THE DISADVANTAGES OF INCORPORATION

- The BSB regulations do not permit a non qualified spouse or civil partner to become an officer or shareholder in an Authorised Body. This restricts the ability to utilise more than one personal tax allowance and basic rate band unless it is possible to employ the partner which many self employed barristers are already doing. The tax advantages of incorporation are restricted to the savings in national insurance since most barristers will still need to draw the post corporation tax profits as dividends.

- The cost to the company in additional tax deposit payable when the director draws out funds in excess of available profits which are treated as a directors loan when not repaid to the company within nine months of its year end.

- The inability of the company to be able to estimate its likely annual profits to ensure that dividends can be legally voted on a regular basis without becoming insolvent, especially where much of the income is derived from conditional fee cases.

- The company cannot purchase and provide the director with a motor car without creating a taxable benefit in kind based on the original cost and CO2 emissions of the vehicle. Other than for zero and certain low emission electric cars this is expensive and inefficient meaning that the director must own the car personally and can only claim mileage rates for business use of the vehicle at 45p for the first 10,000 miles and 25p thereafter.

- The ability to charge the company for the provision of a study at home will need to be re-examined since HMRC will deem the company to have leased the room from the homeowner who will need to account for the income as rent and claim for specific running costs.

- The costs of administration (see below)

COSTS

- Regulatory fees as required by the S.B.

- Advice and cost of establishing a limited

- Drafting of directors service

- Preparation of cessation

- Ongoing costs of dealing with post cessation VAT Returns and

- Bank

- Company Annual

- Administration of PAYE

- Company bookkeeping and annual accounts prepared to company law require-

- Preparation of directors personal tax return

POSITION OF CHAMBERS

Before barristers can practise using a limited company they will need to ensure that they have the approval of Chambers.

It is likely that this will require a change to the Chambers Constitution to allow the limited company itself to be classed as a member of chambers.

Chambers will also need to consider obtaining a personal guarantee from the practising shareholder to ensure that they are not disadvantaged, should the limited company become insolvent.

Chambers will treat the member as having ceased to practise and all outstanding fees will need to be separately accounted for.

The new company will be treated as a new member with a new VAT registration and all fee notes issued will be in the name of the company.

This may cause administrative difficulties in ensuring that fees collected on cases that are incomplete at the date of the change in status are properly accounted for.

Chambers may also need to consider issues arising where shares in the chambers buildings are currently owned by the individual who will no longer be a direct member once operating via a limited company.

Chambers will need to be satisfied that each limited company:-

- Has the approval of the B.S.B.

- Pays all registration and ongoing licence fees to the B.S.B.

- Carries approved professional indemnity insurance

SO SHOULD YOU INCORPORATE?

In our opinion, incorporation should only be considered if:-

- You are earning profits at a level to allow sufficient funds to accumulate in the company bank account enabling you to plan your personal monthly cash requirements accordingly.

- You are able to allow funds to accumulate in the company which can be drawn out as dividends potentially in later years at lower personal tax rates.

- You believe that you may be able to liquidate the company on retirement and take advantage of capital gains tax business assets disposal relief enabling accumulated profits to be taxed at 10% or for the company to become an investment vehicle to provide income in retirement.

In our opinion, you should not incorporate if:-

- You will be doing so on the misunderstanding that you can split your income by having your spouse/ civil partner hold a significant shareholding.

- You need to extract all available income for personal expenditure as soon as it is received.

- You and are in arrears or struggling to meet current income tax liabilities

This is the opinion of Jack Ross Limited based on the information available to us and tax legislation applicable as of 3rd March 2021. This opinion should not be relied upon as the basis for your decision to incorporate. The decision is dependent on personal circumstances and we recommend that professional advice be sought in all cases.

Here at Jack Ross, we consider ourselves to be experts at providing accountancy and taxation advice to members of the Bar.

We will be pleased to meet with you to discuss any questions you have about barrister incorporation.